Any form of passive income is amazing. Technology has ushered in a number of ways for you to have a nice trickle of passive income, and cryptocurrency should be on your radar.

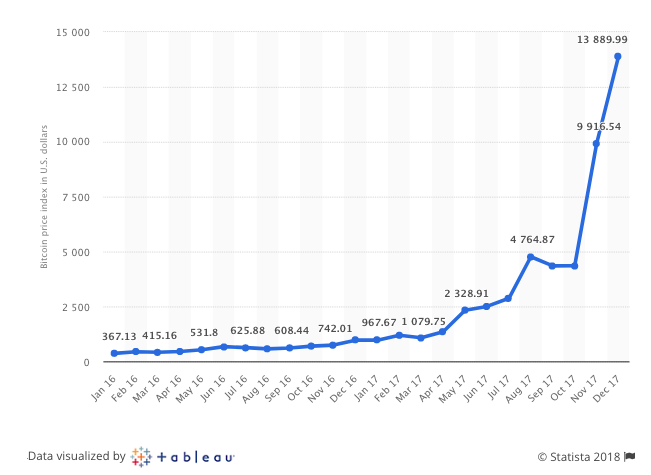

Cryptocurrency has a very lucrative return on your investment. Even stock market professionals are beginning to take notice of this source of investment. For instance, Bitcoins have skyrocketed from $373 to nearly $14,000 in a single year.

The blockchain and digital currencies may very well be the future. You may not be inclined to make cryptocurrency your sole investment, but it can certainly serve as a lucrative source of passive income.

Here are 7 ways to make cryptocurrency one of your passive income sources in 2018.

1. Mining for Cryptocurrency

This is a digital throwback to the gold rush days of yesteryear. Instead of shovels and pickaxes, you will be mining with modern tech. Utilizing hardware CPUs you can begin your cryptocurrency mining at home.

For example, Application Specific Integrated Circuits (ASICs) to mine for Bitcoins. The key to passive income that works when mining for cryptocurrency is to purchase this hardware a good price and have a cheap electricity bill.

Let’s dig into how you can set-up your own cryptocurrency mining operation for a digital passive income.

Tech Skills a Plus, But Not Necessary

Mining for cryptocurrency definitely has passive income potential. But those knowledgeable in tech, hardware, and encryption will find it easier to begin mining. Those without tech skills will need to research mining in-depth to get started. Cryptocurrency mining is continuous, not a set it and forget it way to net passive income.

Choosing Hardware

Your hardware will be at the core of your cryptocurrency mining efforts. This is a computer dedicated to mining. There are a variety of mining set-ups you can use, but the best ones will net you the most and fastest profit.

For example, good mining hardware will cost you well over $500. An average miner could net you about $100 per month. This will be a good indicator of how long it will take to get that return on your investment.

Cryptocurrency Wallet

If you don’t have a wallet yet, you will need one once you begin mining. With a cryptocurrency wallet, you can send and receive digital currency. Be sure to look into wallet features, like amount and payment limits, as they do vary. After that, you will be more than ready to buy some Bitcoin and hold it as long as you want.

Mining Software

Once you have your hardware and wallet set up, get your mining software or a client that can manage your mining process. This client or software can ensure your mining set-up is working effectively.

One of the most important aspects of mining cryptocurrency for passive income is that you continuously update your hardware and make tweaks to your mining process. The more up-to-date, the more profitable mining.

2. Look for Crypto Forks

When people decide their cryptocurrency coins are no longer that great, they will develop a new form of it. This allows you to get a one-to-one crypto exchange from the old one. A recent example of this is when Bitcoin forked to make Bitcoin Cash and Bitcoin Gold.

Here’s how to increase your passive income trickle by capitalizing on crypto forks.

Get In Before the Block Height

If you get into a cryptocurrency before a block height will automatically become equal parts of the new forked digital currency.

A few important crypto fork aspects to consider are:

- You need your balance recorded prior to the snapshot block happens.

- Once the block is recorded to the blockchain you can move your currency.

- Keep access to your wallet’s private keys to access the forked currency.

Once everything is recorded, you simply wait for the new chain to launch, which is up to the developers.

Waiting for Launch

There are a few important things to remember while waiting for the forked currency to launch. The process of a forked coin going live can take weeks or even months. In this time period, you may want to trade away your cryptocurrency, but remember that you are trading away the yet to be released forked currency as well.

Claim Your Coins

Once the forked currency goes live, you can claim your coins. The developers of the new forked currency will announce the launch. When this happens, you will need to create a wallet for your new forked currency using the private keys.

It is also important to not claim your coins to fast. You want to ensure that the coin has replay protection. This will keep you from losing any cryptocurrency in the wallet. Let other test it out and then claim your coins.

3. Take Advantage of Cryptocurrency Airdrops

Cryptocurrency airdrops happen when developers of specific crypto coins distribute more of the digital currency. This happens for a variety of reasons, but mainly to thank holders of that specific coin type for something they do, or just being involved.

To take advantage of cryptocurrency airdrops, you need to hold coins from the relevant blockchain in your wallet. For instance, if the company or organization doing the airdrop has Ethereum, you will need Ethereum.

Airdrops are giveaways that happen at a scheduled time, and when the time arrives the project coordinators will take a snapshot of the blockchain. If you hold say Ethereum at the time of the snapshot, you will get a number of free tokens.

Organizations like the Blockchain Education Network will often organize airdrop events simply to raise cryptocurrency awareness. These events are a great way to get some passive income rolling in while also bettering the digital currency industry.

4. Become a Masternode

The infrastructure of cryptocurrencies is essential. Helping out by securing the network of digital currency can net you a very nice passive income. This is achieved by running a masternode. You simply put your masternode in place and let the server run, thus continually netting coins for your help.

Before becoming a masternode, it is essential to know the about the best masternodes, how to be profitable as a masternode as well.

To recoup your masternode investment and begin earning a passive income, you will need to know the ROI of a masternode. The ROI depends on:

- Price of bond

- The block reward

- The number of masternodes in operation

- Cost to host

- Tax requirements

- Selling price of mined tokens

- Selling price of bond

Next, you need to know what masternode to invest in. Masternodes provide very important network services, and they can be used to do a number of things, so it is important to do a bit of research. Question to consider include:

- Can the coin be used for anything else outside the masternode?

- What is the demand for the coin?

- What is the number of coins needed to operate the masternode? Is it fixed?

- Are current masternode operators happy?

- Is it centralized or decentralized?

- What are the returns?

- Any block rewards in the future?

5. Go for Capital Gains

Capital gains are often overlooked as a passive cryptocurrency income source. Since the market price is strong some say it may just be a bubble and risky. Whatever the risk, investing part of your cryptocurrency budget into coins that are not doing as well could pay off in the long-term.

The cryptocurrency market can change at any moment. To capitalize and get the most of your capital gains, you should always be tuned-in to the digital currency industry. This will allow you to identify currencies that have dropped significantly but are predicted to increase down the road.

For example, Bitcoin (BTC) took a nosedive by nearly 50 percent before the New Year. This would have been a moment to buy because your investment would have netted a very nice passive income.

Keep an eye on major cryptocurrencies like Bitcoin, Ethereum, Stellar, NEO, NEM, and Ripple. Also, don’t be afraid to research Bitcoin Gold, a fairly recent forked currency that has a low investment currently.

6. Invest in Lending Services

Just like the present traditional bank structure you can invest in landing services to get a return on your principal capital. How? Well, with cryptocurrency you are your own digital bank in a sense.

This means that you as a lender can invest your money in crypto lending and get interest payments for that. In the crypto lending process, three parties are involved: lenders or investors, borrowers, and crypto lending platforms. It is crucial to choose the right crypto lending platforms to maximize your income and minimize risks. There are two main types of crypto lending platforms to choose from: automated and manual, which generally regard the way of the investment that is being made.

This can generate a nice passive income stream, but be wary of lending services that have poor reviews. There are a lot of scams out there, so do your due diligence before investing in lending services.

Dedicating 100 percent of your funds to cryptocurrency lending services wouldn’t be a wise move. It is important to diversify your cryptocurrency passive income investments, just as you would a stock portfolio. There are plenty of pros and cons to weigh, whether you’re investing 10 percent or 60 percent of all your funds.

Lending services advantages include:

- Easy to generate passive income with automated services that are generally not time-consuming on your part.

- Cryptocurrency lending services are generally low-risk investments.

- There is a much higher APR than keeping your money in traditional financial institutions.

Disadvantages of lending services are:

- Lower returns, so expect a very slow passive income trickle with this strategy.

- Capital is tied up so you may miss out on other investment opportunities that arise.

- The exchange can be hacked or close, and you will lose all your investment.

7. Staking for Passive Digital Income

Similar in nature to dividends you can create a stake, or proof of stake by leaving your digital wallet open. In return, you will net a nice percentage of the cryptocurrency you stake.

For instance, Neblio has a ten percent return on your annual holding amount. This gives you a passive income trickle on your monthly percentage return.

- Unlock your wallet. To stake, you will need to unblock your wallet if encrypted. A locked wallet will not stake. One of the biggest benefits of staking is that once your wallet is unlocked, it will stake for you automatically.

- Know token age. Token age is simply the age of your tokens. When tokens are staked and sent to another address, the token age is reset to zero.

- Minimum and maximum token age. The minimum token age you should aim for is 24 hours. The maximum token age is seven days. After seven days pass your tokens stop acquiring weight.

Stake is only rewarded based on token age, rather than calendar age. Let’s say you have 5,000 NEBL with a calendar age of 6 months. Regardless of how long you’ve had the stake, the maximum token reward is for seven days. This incentivizes users to keep wallets open and secure the network.

Are You Ready to Make Cryptocurrency Passive Income?

Passive income is great, and earning a little more every month with cryptocurrency is definitely doable. However, be sure to do your homework and invest smart. Yes, the digital currency market is booming, but that can change while you sleep. Any investment is risky. It all depends on your unique comfort level.

About the Author